Economists to America: “Honey, we broke the calculator!”

Posted: December 1st, 2008 | Author: Maha Rafi Atal | Filed under: Data, Economics | Tags: GDP, Great Recession, income, income inequality, NBER | 2 Comments »Once a month, the US government locks a bunch of Econ PhDs in a room to calibrate changes in employment, payroll, production and consumption. Today, the experts announced the results of their November gathering. Guess what? We’re in a recession, and we’ve been there since December 2007.

Well, duh. Americans have been feeling the hit for months.

But economists usually wait around for two consecutive quarters of negative GDP growth before calling a recession. That definition rests on the fact that production, consumption and income are interlinked: what a country makes must add up to what it buys. In theory, when GDP is rising, it should be because consumption (roughly 70% of the domestic product figure) is rising too. And when people consume more, it should be because their employers are making more and passing it on.

That means that most of the time, the line about the rich getting richer while the poor get poorer is just gas. Income disparity is growing, but that usually reflects the rich getting richer faster than the poor are emerging from poverty. Assuming that income, consumption and production all move in the same direction justifies A) the 2-quarter definition of a recession and B) the argument that getting people to make and buy more stuff must implicitly raise our standard of living.

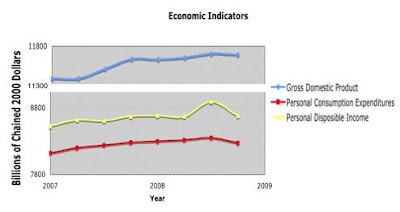

That’s apparently no longer the case. In the first half of 2008, the size of the economy bobbed up and down but didn’t plummet consistently enough to merit the R-word. This summer, GDP took a slight dip (at an annual rate of -.5%) as did consumption (at a annual rate of -3.7%), but that didn’t get us over the 2-quarter mark.

Yet employment and income figures have been trending downwards since December of last year, moving at times in the opposite direction to GDP. Ordinary Americans were losing, or barely holding, their income while the economic pie grew, and hemmoraging it once the economy started to shrink.

Source: Bureau of Economic Analysis. NB the PDI spike in early 2008 reflects the stimulus package, and is an artificial gain.

It’s this divergence, the NBER says, that justifies calling a recession:

“The committee believes that the two most reliable comprehensive estimates of aggregate domestic production are normally the quarterly estimate of real Gross Domestic Product and the quarterly estimate of real Gross Domestic Income, both produced by the Bureau of Economic Analysis. In concept, the two should be the same, because sales of products generate income for producers and workers equal to the value of the sales. However, because the measurement on the product and income sides proceeds somewhat independently, the two actual measures differ…The differences between these two sets of estimates were particularly evident in 2007 and 2008.”

Decode the jargon and the release says something like this: “The economy must be pretty screwed up, because the math we use to detect a screw-up isn’t working.”

Ouch. The economy must indeed be screwed up to break the decades-long correlation between income and GDP. If the income measure of economic health is now the right indicator, then the recession is already longer than the 10.5 month average for recessions since World War II. And if the economists’ calculator broke on the way down, who is going to chart the way up?

at a talk yesterday moderated by michael kinsley, a prof. easterly said some of the same things. i am not as attuned to market economics, but if i make myself an example, i won’t start spending again until i have economic security, including a universal healthcare plan

[…] the early months of the financial crisis, I wrote up a post that attempted to look at the relationship between income inequality and economic catastrophes, […]